- February 14, 2024

- Bookkeeping

- Comments : 0

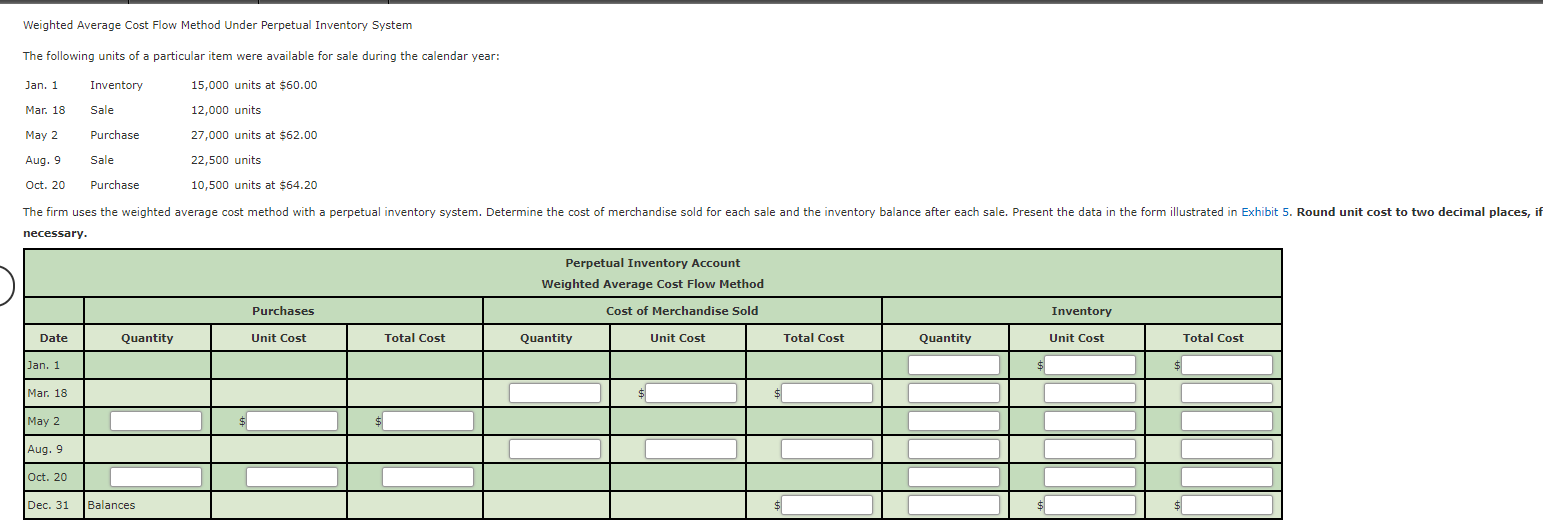

Perpetual Inventory System: Definition & Methods

Under this system, no purchases account is maintained because inventory account is directly debited with each purchase of merchandise. Under perpetual inventory system, the expenses that are incurred to obtain merchandise inventory are added to the cost of merchandise available for sale. These expenses are, therefore, also debited to inventory account under this system. The general examples of such expenses include freight-in and insurances expense etc. Each time the merchandise is sold, the related cost is transferred from inventory account to cost of goods sold account by debiting cost of goods sold and crediting inventory account. In this section, we will discuss some of the key formulas used in perpetual inventory systems to help businesses effectively manage their stock levels and make informed decisions.

How to Avoid Overstock Inventory in Ecommerce in 8 steps?

Each of these methods has its pros and cons when it comes to use within a perpetual inventory system. Overall, once a perpetual inventory system is in place, it takes less effort than a physical system. Explore how to calculate ending inventory accurately for better stock and profit control. A perpetual inventory system lets you investigate any stock level discrepancies and make necessary stock adjustments when required.

Point-of-Sale Systems

This is especially important if certain financial records have to be kept for banks and other lenders. You must choose between a periodic inventory system and a perpetual inventory system. Select the best approach for your business, and then research to support your choice. It helps maintain good accounting standards by automating billing, invoicing, and payment processing tasks. Consider the scenario where you must estimate the ending inventory for the current month.

Is It Necessary to Take a Physical Inventory When Using the Perpetual Inventory System?

Thisexample assumes that the merchandise inventory is overstated in theaccounting records and needs to be adjusted downward to reflect theactual value on hand. A perpetual inventory management system is a method of inventory tracking that updates inventory records automatically whenever a transaction occurs. This system keeps an ongoing count of stock levels, whether items are sold, restocked, or moved in or out of inventory. The perpetual inventory system gives real-time updates and keepsa constant flow of inventory information available fordecision-makers. With advancements in point-of-sale technologies,inventory is updated automatically and transferred into thecompany’s accounting system.

- This requires the use of point-of-sale terminals, barcode scanners, and perpetual inventory software to update estimated inventory with every product purchase and sale.

- She will use this information to calculate the ending inventory and COGS for the period.

- In a perpetual inventory system, the software tracks stock movement continuously.

- The LIFO (last-in, first-out) perpetual inventory method is the opposite of FIFO and makes a cost flow assumption that the last items received in inventory are the first items sold.

Formulas used in perpetual inventory methods

A company knows, after each transaction, how much it costs to produce products sold at that point. Perpetual inventory systems track sales constantly and immediately with computerized point-of-sale technology. Periodic inventory systems only track sales when a physical count is ordered and require a point-in-time count. The differences between perpetual and periodic inventory systems go beyond how the two systems function, although that is the main point of distinction. System software provides real-time updates to inventory through the use of barcode scanners or other computerized records of product acquisition, sales, and returns as they occur.

Understanding Perpetual Inventory Systems

In this guide, we’ll explore the main perpetual inventory formulas and methods before looking at some of the advantages of using a perpetual inventory system in your business. New technologies are allowing businesses to receive ongoing inventory updates with the help of perpetual inventory techniques. A perpetual inventory system tracks inventory movements and interactions throughout your ecommerce supply chain. This data will give you more insights about bottlenecks in your procedures, so you find ways to optimize your supply chain. Thanks to recent advancements in technology, it is much easier for brands of all sizes to implement a perpetual inventory system. Brands can collect data through IOT devices such as RFID tags, barcoding scanners, and sensors, and access real-time data through cloud-based software solutions for constant visibility.

Generally Accepted Accounting Principles (GAAP) do not state arequired inventory system, but the periodic inventory system uses aPurchases account to meet the requirements for recognition underGAAP. The main difference isthat assets are valued at net realizable value and can be increasedor decreased as values change. The economic order quantity (EOQ) formula is used to determine the optimal order quantity that minimizes the total inventory cost, including ordering, holding, and storage costs. In the FIFO inventory valuation method, the items purchased first are sold first.

By examining these aspects, we can better understand their impact on financial statements and compare them with periodic systems. A perpetual inventory system keeps continual track of your inventory balances. These are only required in periodic inventory system to update inventory and cost of goods sold while the perpetual inventory system does not require closing entries for inventory account.

On 1st April 2013, Metro company purchases 15 washing machines at $500 per machine on account. The supplier allows a discount of accounts payable duplicate payment audits 5% if payment is made within 10 days of purchase. The Metro company uses net price method to record the purchase of inventory.